Corporate trade and sponsorship ROI

In a precision marketing world, there are some who say the art of mass reach and brand building is losing its way. Tactics for building brands are set aside in favour of data-driven programmatic efficiency.

And yet, tried and true methods such as TV, out-of-home and sponsorships can help brands become memorable in a cost-effective way.

Sobeys’ “Feed the Dream” and Canadian Tire’s “We All Play for Canada” are just two of many great examples of how media sponsorships, when planned and aligned carefully, can supercharge branding, reach and resonance with consumers.

So why are more brands not leveraging sponsorships in their media mix?

Sponsorship barriers: Doing more with less

There are many pressures in the marketplace including changing consumer behaviour and expectations, supply chain disruption, marketing budget challenges, intense competition, and greater need for innovation. In 2020 we witnessed many media campaigns paused, cancelled, and deferred due to paralysis from the pandemic. In a “do more with less” culture, sponsorships have come under fire due to massive disruption, financial risk management and inability to quantify return on investment (ROI).

Corporate trade as an ROI tool

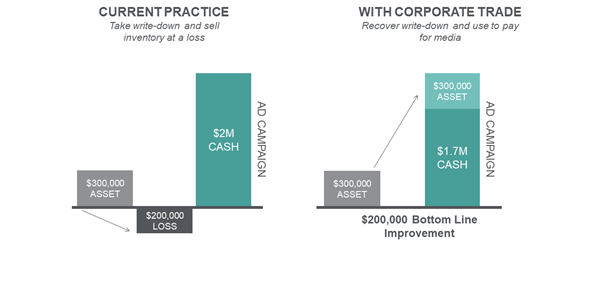

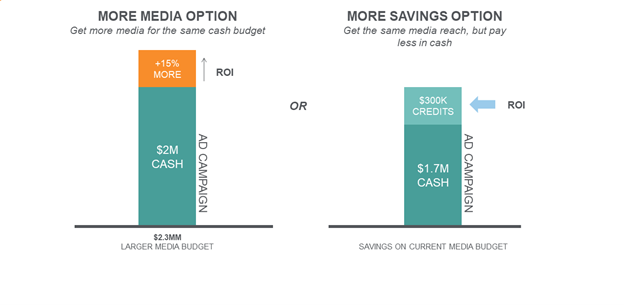

Paying for media with cash alternatives is a smart way to give a media budget, and campaign ROI, a boost. There’s a name for it: Corporate trade, and many recognizable brands use it strategically.

In a post-pandemic world, I have seen a renewed business vigour to embrace corporate trade as a method to improve brand health and maximize profitability by converting excess assets into advertising equity.

By using corporate trade as a strategic media budget tool, brands can partly fund sponsorships by utilizing assets like excess inventory as currency. This is smart for two reasons: Not only do they create new media budget (or protect existing media budgets from cuts) with less cash, but they also restore all or part of the depreciating value of the unsold inventory.

Managing sponsorship risk

Let’s look at from a slightly different angle: Risk. I’ll assume that for whatever reason a three-year sponsorship secured with a media partner is no longer valid or relevant. In this scenario, a corporate trade company can assume liability of the remaining sponsorship term, find a partner that is better aligned, and free the business of the obligation. In return, the business that initially secured the sponsorship re-directs an agreed upon portion of future media spend through the corporate trade company’s media buying team. It’s a win-win-win: The original business has freed up media dollars to put towards something new, a different brand assumes the remainder of the sponsorship which will drive better value for them, and the media vendor now has an eager new brand to look to the future with.

Sometimes tried and tested brand building methods are worth taking a second look at, especially with innovative solutions to some of the common barriers. Measuring sponsorship against sales is vital, although inefficient measurement frameworks are still being used by many organizations. Smart companies are looking to assets to help support sponsorship initiatives. If you’re a media vendor or a business currently investing in media and sponsorship, you likely want to consider corporate trade to meet your needs.