Understanding Canada’s changing media habits: Essential insights for marketers

Canada’s media habits are evolving rapidly, shaped by shifting demographics and a growing preference for digital experiences. From streaming platforms to social media, Canadians are redefining how they engage with content, presenting exciting opportunities for marketers to connect in new and meaningful ways. In this article, we explore the key trends driving these changes and share insights to help marketers navigate and thrive in this dynamic landscape.

Surprising statistics: How Canada’s media habits defy expectations

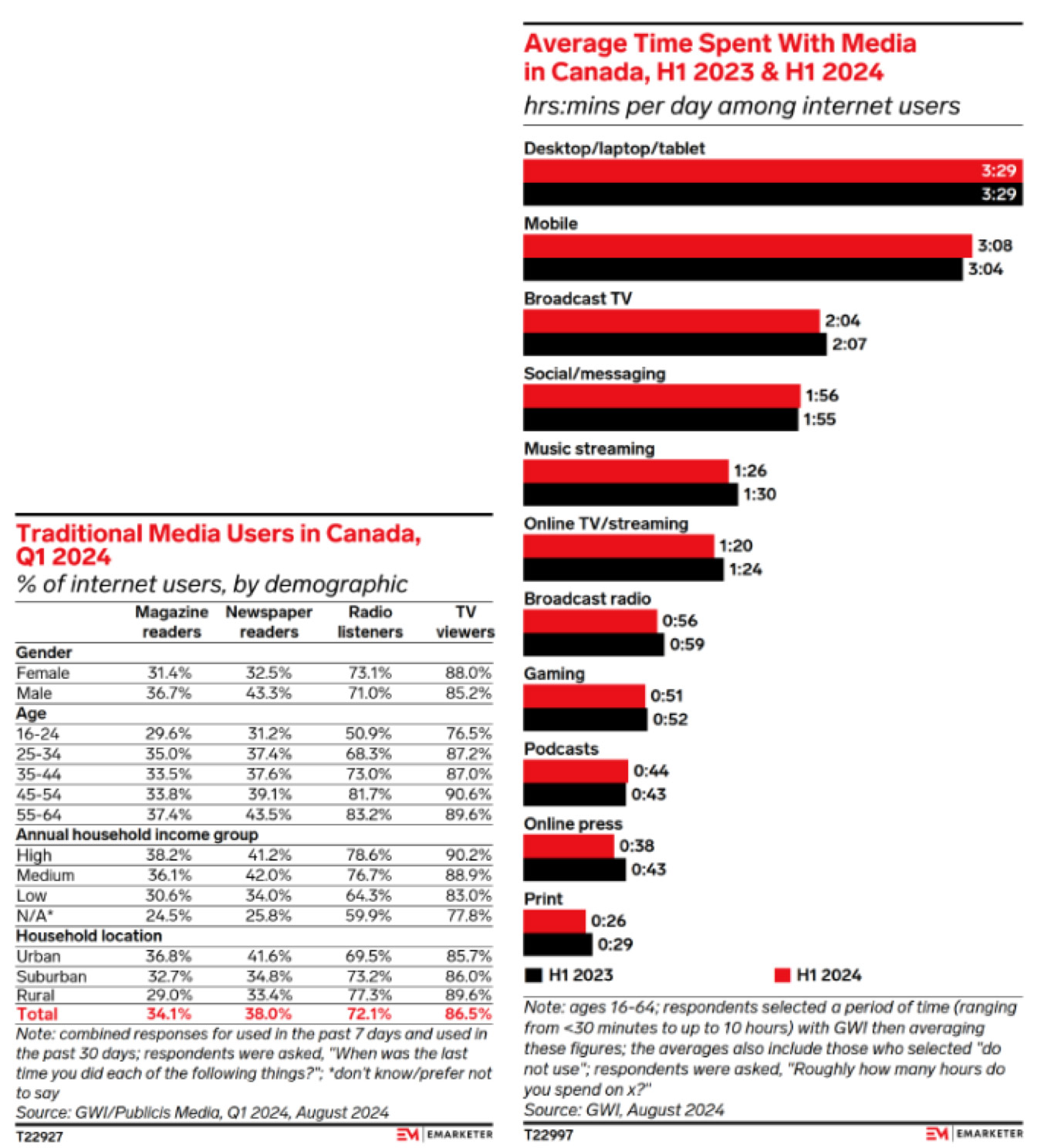

Canada’s media habits reveal intriguing contrasts, with digital platforms dominating but traditional formats still holding pockets of influence. Some findings from eMarketer are below:

- Streaming is the top choice for long-form content, with 92.5 per cent of internet users opting for on-demand viewing. Recorded TV sees higher popularity than in the U.S., by more than five percentage points.

- Audio consumption reflects a balanced split between radio and music streaming, with younger, urban and high-income Canadians favouring digital audio.

- Social media usage is nearly universal (97.1 per cent), with Canadians focusing on fewer platforms compared to global trends, signaling a selective approach to digital engagement.

Traditional media formats like TV, radio and print are seeing a steady decline, though newspaper readership remains stronger in Canada than the U.S., thanks to robust urban availability. Meanwhile, mobile device usage lags behind global averages due to high data costs, but smart home technology and video-on-demand services are thriving across demographics. As Canadians embrace streaming, voice assistants and focused digital consumption, the country’s media landscape is evolving into a blend of modern preferences and unique quirks, reflecting both global influences and local realities.

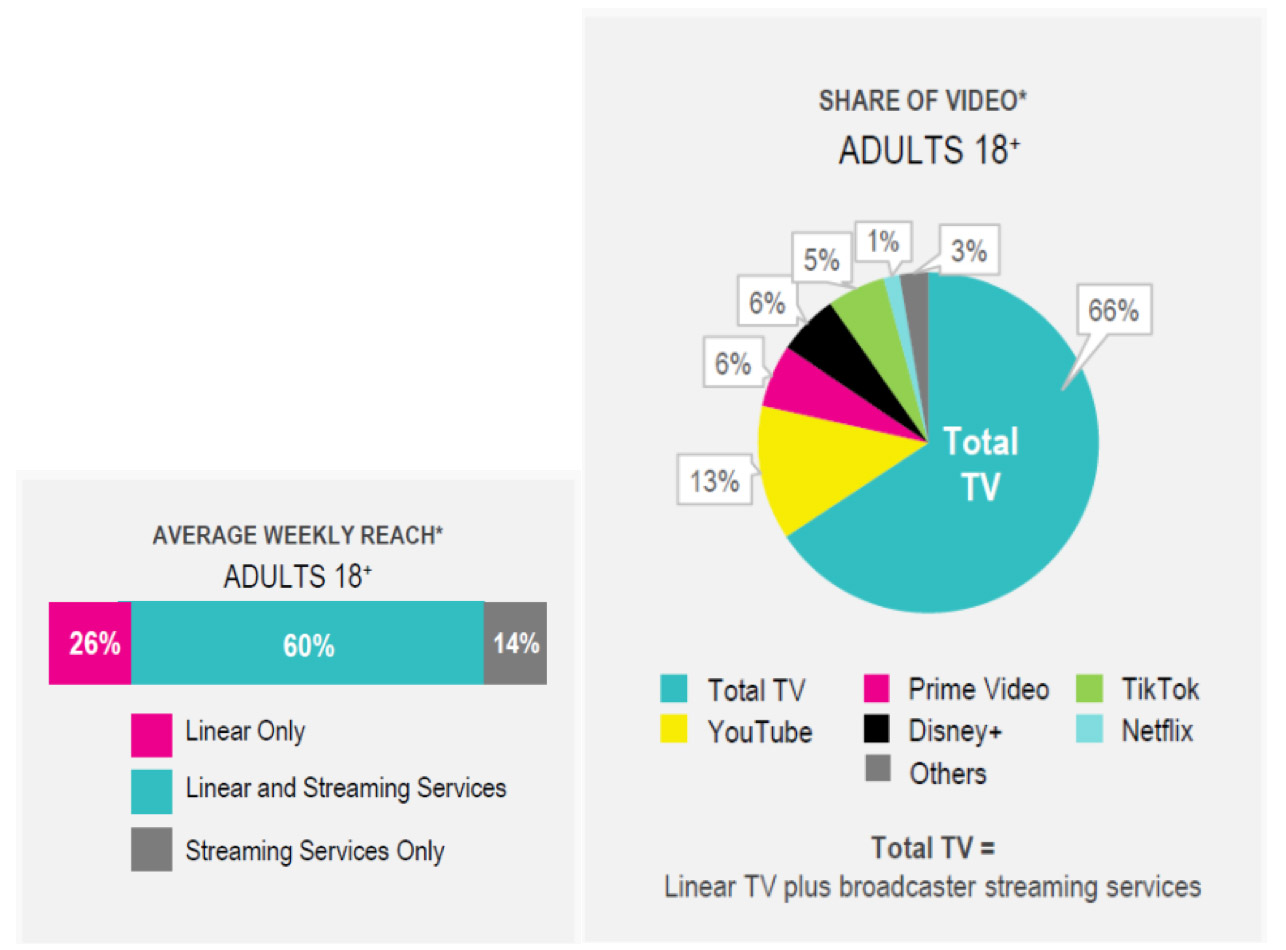

Why “Adults 18+” is the new gold standard in Canadian advertising

Canada's shifting demographic and cultural landscape is reshaping how advertisers target TV audiences. With population growth driven by immigration and an aging populace—median age rising from 33 in 1990 to 41 today—targeting the traditional “Adults 25-54” cohort has become less relevant. This group’s modest 4.7 per cent growth since 2010 contrasts sharply with the 16 per cent overall population increase. Meanwhile, delayed adulthood and evolving life stages influence purchasing behaviours, as younger adults focus on education and savings while older adults, with five times the wealth of their younger counterparts, spend actively on experiences. Broadening the audience to “Adults 18+” ensures advertisers tap into a larger, more diverse consumer base, better aligning with these trends.

© thinktv

Source: Unlocking the power of the Adults 18+ audience.

*Numeris VAM, Sep 18, 2023 – May 26, 2024, Ontario, composition of average weekly reach (%). Streaming channels include: YouTube, Prime Video, Netflix, Disney+, Apple+, Crave (OTT only), CBS News, Twitch TV, ET Online US, TubiTv, DAZN, Paramount+, PlutoTv, FuboTV, Daily Motion, Roku Channel, Crunchroll, Discovery+, TED, SamsungTV (in home viewing).

The “Adults 18+” demographic offers enhanced cost efficiency and strategic flexibility in a fragmented media landscape. By leveraging advanced targeting tools such as behavioural, psychographic and geographic data, advertisers can refine campaigns to reach the most relevant segments while maintaining cost-effective CPMs. This approach also harmonizes with cross-platform practices, simplifying campaign planning and evaluation. With the transition to “Adults 18+,” marketers can move beyond narrow demographic metrics, using advanced advertising solutions to drive engagement and conversions while maximizing ROI. This shift reflects Canada’s evolving consumer dynamics, ensuring campaigns resonate across life stages, values and interests.

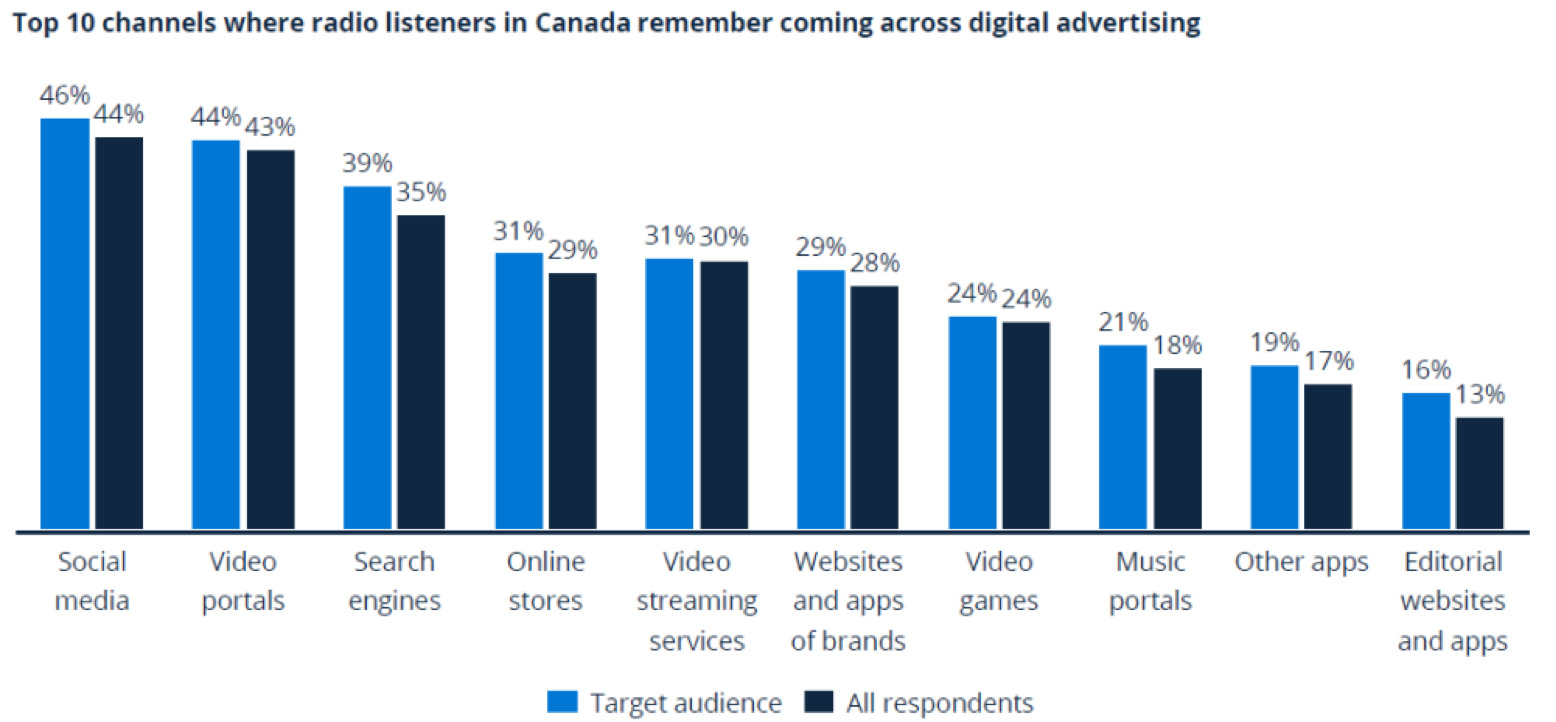

Understanding the Canadian radio audience

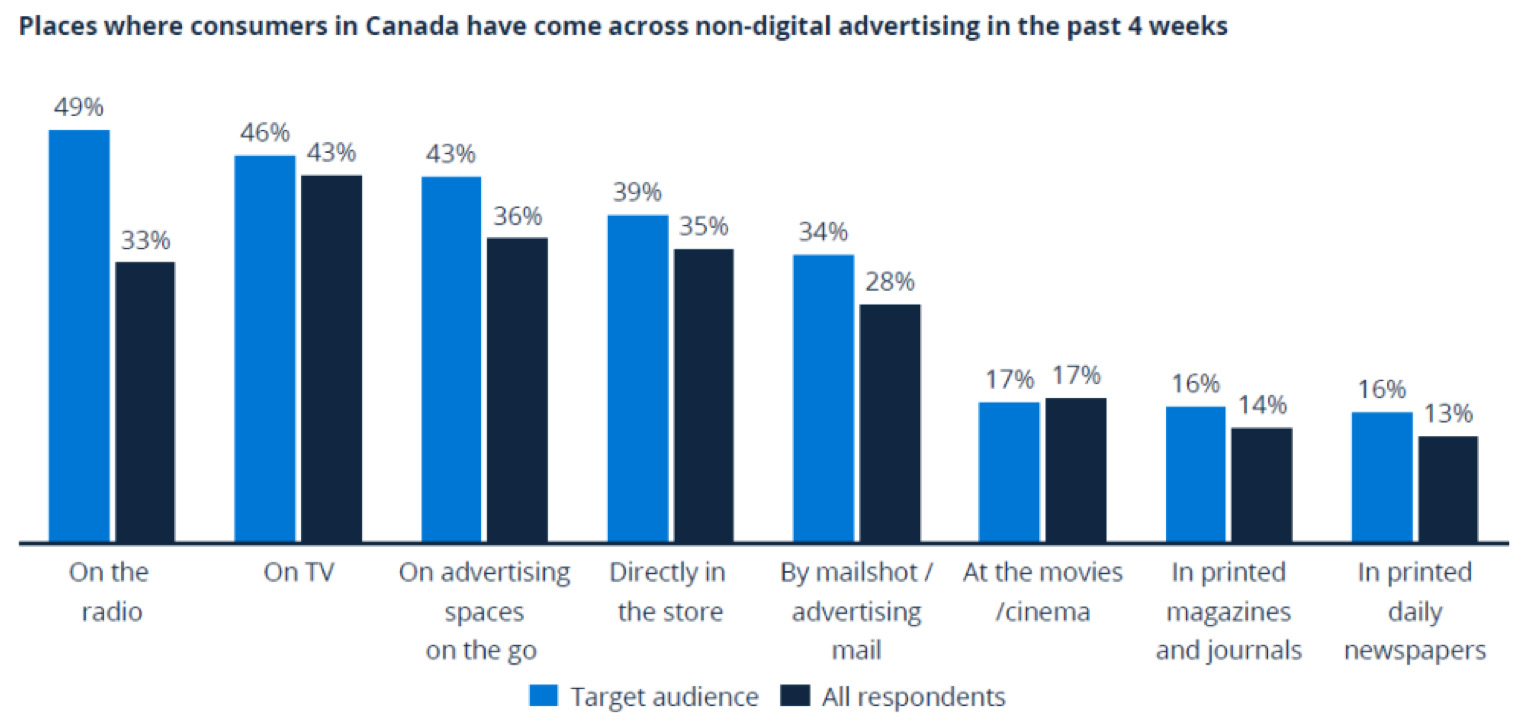

As outlined by Statista, Canadian radio listeners represent a diverse and engaged demographic, skewing older, with 35 per cent from Generation X, and 51 per cent identifying as female. They live in various community types, with many owning their homes and having high household incomes (37 per cent). This audience values hobbies like outdoor activities, follows sports like ice hockey more avidly than average consumers, and enjoys entertainment such as movies and music. Additionally, they express interest in discovering new content through digital services, making social media platforms like LinkedIn significant touchpoints for brand engagement. Radio listeners also have a centrist political leaning and demonstrate greater sensitivity to rising living costs and economic challenges compared to the broader Canadian population.

Source: Consumer Insights report, Target audience: Radio listeners in Canada.

*Global, as of September 2024. Notes: “Where have you come across digital advertisements in the past 4 weeks?’’; Multi Pick; How many hours per week do you spend using the following services? Radio; Single Pick; Base: n=1136 radio listeners, n= 12127 all respondents.

© Statista

Source: Consumer Insights report, Target audience: Radio listeners in Canada.

Global, as of September 2024. Notes: “Where have you come across non-digital advertisements in the past 4 weeks?’’; Multi Pick; How many hours per week do you spend using the following services? Radio; Single Pick; Base: n=1136 radio listeners, n=12127 all respondents.

Marketers can effectively connect with this audience by combining traditional radio advertisements, which they recall more frequently than other consumers, with targeted digital campaigns on social media and professional platforms. A focus on relatable themes such as affordability, entertainment and community well-being can resonate strongly. By tailoring campaigns to the unique preferences and habits of Canadian radio listeners, brands can foster meaningful engagement and build trust with this influential group.

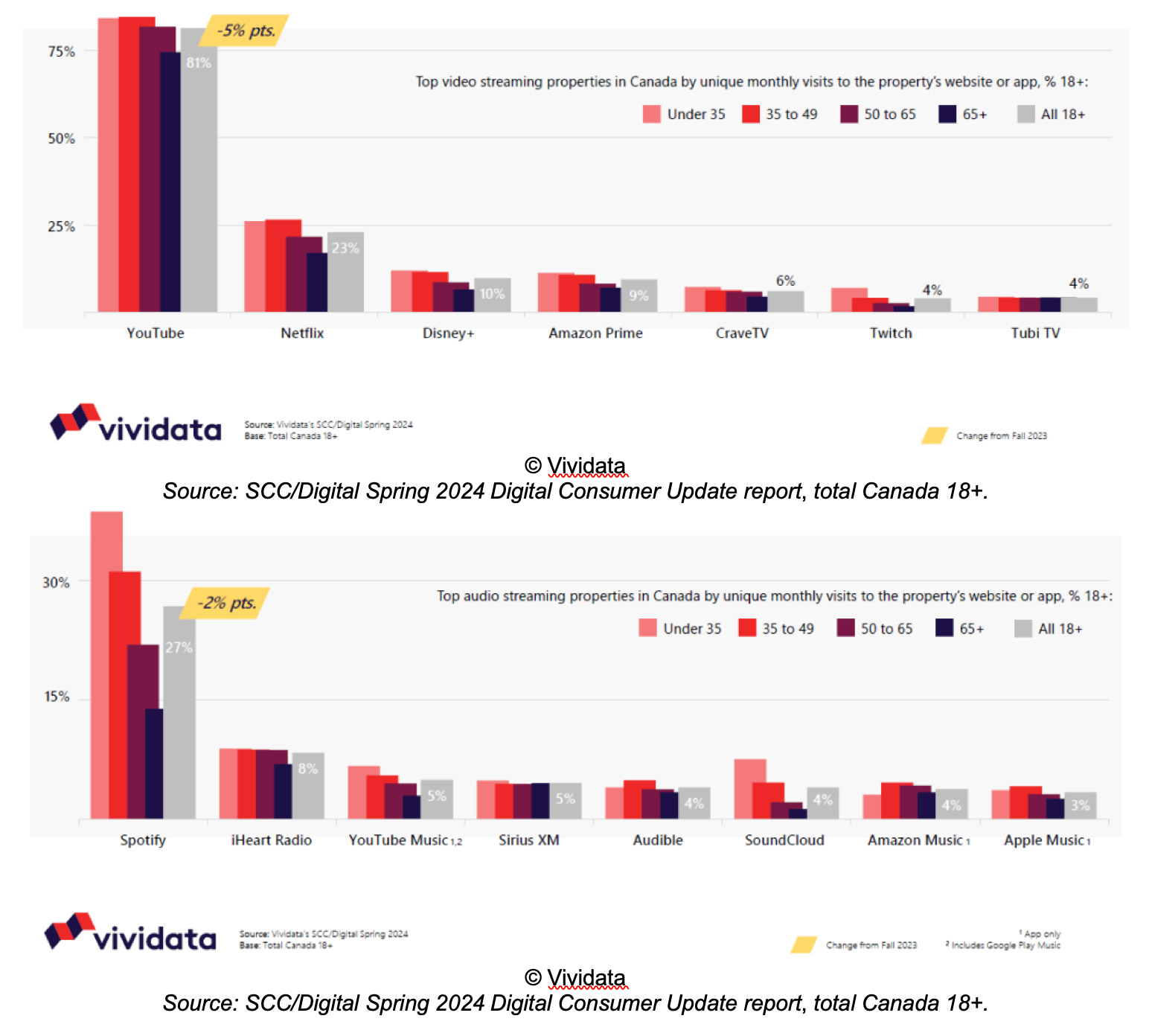

Canada’s digital pulse: A deep dive into spring 2024 trends

Canada’s digital landscape is shaped by evolving consumer behaviours across video, audio and social platforms.

YouTube leads the video streaming market, reaching 81 per cent of Canadians monthly across all age groups, while Netflix, Amazon Prime and Disney+ maintain significant footholds. Canadians aged 18-34 spend 63 per cent more time noticing ads on streaming platforms compared to older groups, highlighting the potential for targeted campaigns.

Audio streaming is led by Spotify, reaching 29 per cent of Canadians overall and nearly 40 per cent of those under 35. Urban and younger audiences lean heavily toward genres like hip hop and rap on Spotify and SoundCloud, while classic rock remains popular among Audible users. TikTok and Reddit, though reaching fewer than 30 per cent of Canadians, rank among the top three for time spent, showcasing their strong user engagement.

Social platforms dominate digital engagement in Canada, with Facebook leading in reach, followed by Instagram and TikTok. While Facebook attracts an older demographic, TikTok excels among younger users, ranking in the top three for time spent. Pinterest bridges the generational divide with balanced user demographics, and Snapchat and Instagram remain favourites for the “Under 35” group. These trends reflect shifting preferences for creative and targeted advertising opportunities across platforms.

Amazon continues its dominance as Canada’s top online shopping platform, engaging 71 per cent of adults, while Canadian Tire and Apple attract high-spending shoppers. Female users drive engagement on platforms like Etsy and Wayfair, while men dominate Microsoft and Samsung traffic. Canadians’ digital-savvy behaviour is mirrored by their average six hours of daily online activity, emphasizing the importance of mobile-optimized and personalized marketing strategies. With Canadians deeply embedded in the digital world, platforms that combine targeted, creative and immersive experiences offer unparalleled opportunities for marketers.

Key areas of focus for 2025

Below are a few important focus areas for media industry marketers and advertisers this year:

- AI and personalization: Artificial intelligence is revolutionizing how marketers understand and engage their audience. AI-powered tools can influence creative placement, and messaging, when combined with demographics and past behaviour data.

- Short-form video content: Marketers should prioritize creating engaging, bite-sized video content, including lifestyle content, to captivate audiences and drive engagement. This may include short commercials, behind-the-scenes footage, user-generated content and more.

- Influencer marketing and creator partnerships: To maximize their reach, marketers should partner with influencers who align with their brand values and can create authentic content that resonates with their audience.

- Data privacy and ethical marketing: Marketers must commit to ethical data practices, including obtaining explicit consent, responsible data usage and transparency, to build trust and thrive in today's digital landscape.

To succeed in today’s complex and rapidly evolving media environment, Canadian marketers must embrace a multifaceted approach that accounts for shifting consumption trends and the diverse ways audiences interact with content. This means adopting experience-driven advertising strategies that prioritize authenticity, personalization and engagement, while also leveraging data to align messaging with the evolving preferences and behaviours of Canadian audiences. Marketers can gain a competitive edge by utilizing a wealth of high-quality, credible Canadian research from sources such as eMarketer, thinktv, COMMB, Radio Connects, News Media Canada, Vividata, Numeris, Comscore, IAB Canada, CRTC, Environics and Guideline. These resources offer valuable insights into media consumption patterns, channel effectiveness and emerging opportunities, equipping advertisers with the tools needed to craft strategies that are not only impactful but also adaptive to Canada's dynamic media landscape.

Sources:

- eMarketer, Global Media Intelligence 2024: Canada, October 2024

- Thinktv, Unlocking the power of the Adults 18+ audience, October 2024

- Vividata, Digital Consumer Update, SCC/DIGITAL, Spring 2024

- Statista, Consumer Insights report – Target audience: Radio listeners in Canada, September 2024

Authors:

Vineeta Menon, Sr. Manager, Insights & Analytics, Rogers Sports & Media

Darrick Li, VP Client Partner, North America, Guideline (Standard Media Index)