The changing media mix

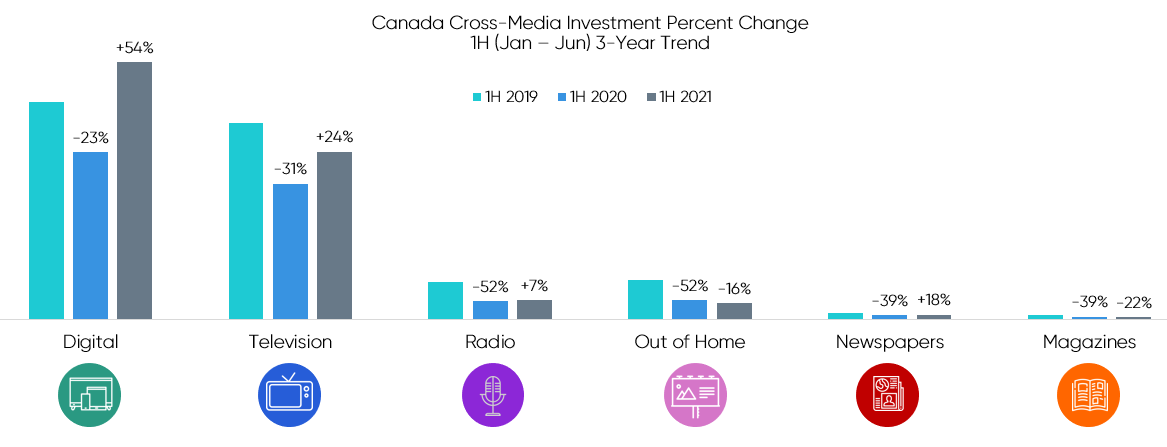

Source: Standard Media Index Core, Canada

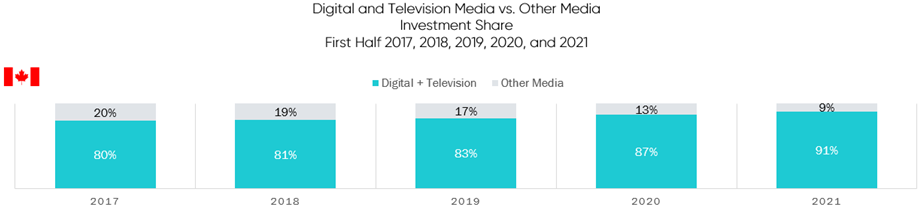

To understand the impact of this shift, it is important to look at the “Other” media types that account for the 9% of media investment share. Print, Radio, and OOH are now ‘fighting for the crumbs’, and have a larger uphill battle in regaining investment share. All three mediums together have not grown in investment versus the same period last year (the start of the pandemic) and are far from returning to pre-pandemic levels, down in total -48% versus the same period in 2019. Digital and Television, however, combine to having grown +40% versus the same period last year, and surpass 2019 levels, up +2%. Below is a detailed look at the investment change by each medium.

Source: Standard Media Index Core, Canada

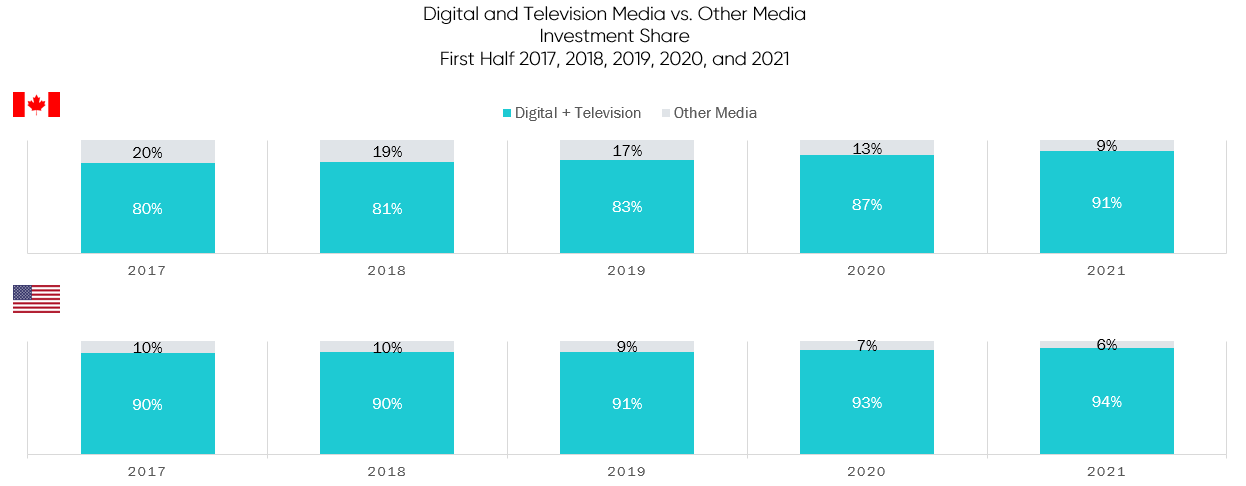

For comparison, the shift to Digital and TV in the US has also grown in the same direction and was fueled by the pandemic, as it was in Canada. The share of investment in the US is even more pronounced, leaving other media to fight over only 6% share of ad spend.

Source: Standard Media Index Core, Canada

This presents an opportunity to keep an eye on in the coming 12 months. Will Print continue to hold its share as it continues its transition to digital formats? Will pedestrian and vehicular traffic revive OOH and Radio media as more return to the office? Will OOH see a resurgence with the boost from programmatic digital OOH transacting? Or will we see the shift continue for Digital and Television, as it has in the US?

These insights are driven by Standard Media Index’s Core solution in Canada, sourced directly from the major holding company and leading independent agencies. As the Canadian ad market strengthens through 2021, SMI will keep the market informed on shifts in this nature and which advertising categories and media companies are benefiting from the changing media mix.